Is there a necessity to offer English subtitling for foreign-language content hubs?

SBS – the first broadcaster to provide English-subtitled foreign-language content on broadcast TV and also providing such content through video-on-demand.

An issue that will crop up with foreign-language video content providers who operate in a particular language is market pressures to offer English-subtitled versions of their content that they offer.

Popularity of English-subtitled foreign language content

There is a significant interest in English-subtitled foreign-language video content especially amongst discerning cinema and TV viewers.

This kind of foreign-language content was initially facilitated in Australia since the 1980s by SBS as part of that broadcaster’s initial multicultural remit. But there has been recent interest in the UK in this content thanks to the arrival of BBC4 who took on a high-brow content approach similar to SBS or HBO. In the USA, a significant number of premium cable-TV channels have been offering this kind of content because such content is similar in calibre to what the likes of HBO and Showtime are offering which appeals to discerning viewers.

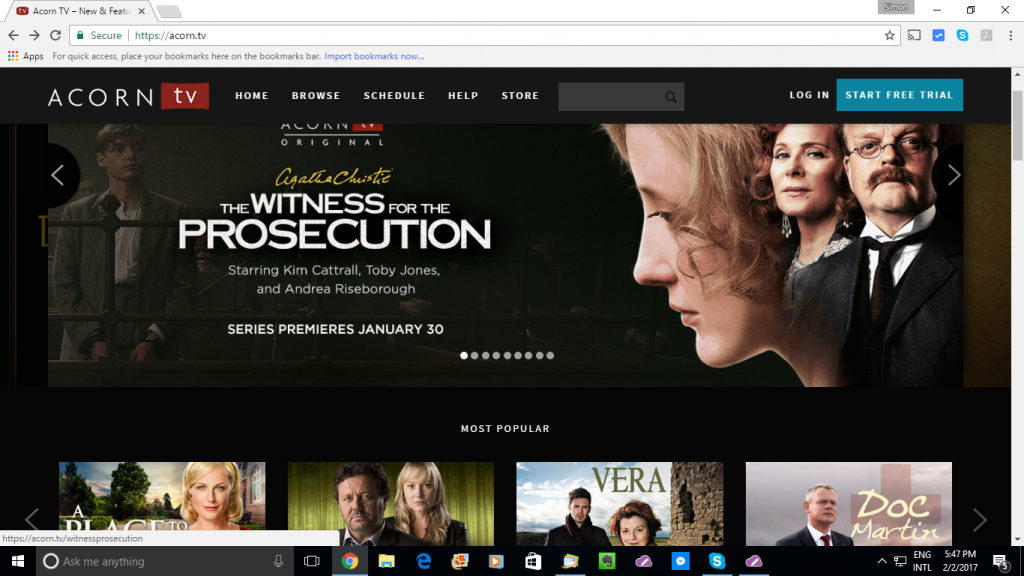

Video-on-demand, still seen as a way to deliver premium TV content, is being used to bring more foreign-language TV content to many homes. This is more so with Netflix and similar premium subscription services but could also apply to transactional or advertising-driven services. FAST (Free Ad-Supported Streaming TV) services are also appearing that bring in this kind of foreign-language TV content.

It isn’t just the multicultural communities who are interested in film and TV content produced by their homelands or in their native tongues. But an increasing number of English-language viewers want to view the cultures that exist beyond their country’s borders or beyond the Anglosphere’s realms. This is more so where these countries exhibit different social norms to what is expected in the Anglo-American culture. Let’s not forget that an array of non-Anglophone countries are seeing their culture as part of their soft power that is to be promoted and exploited such as with the “Cool Japan” effort.

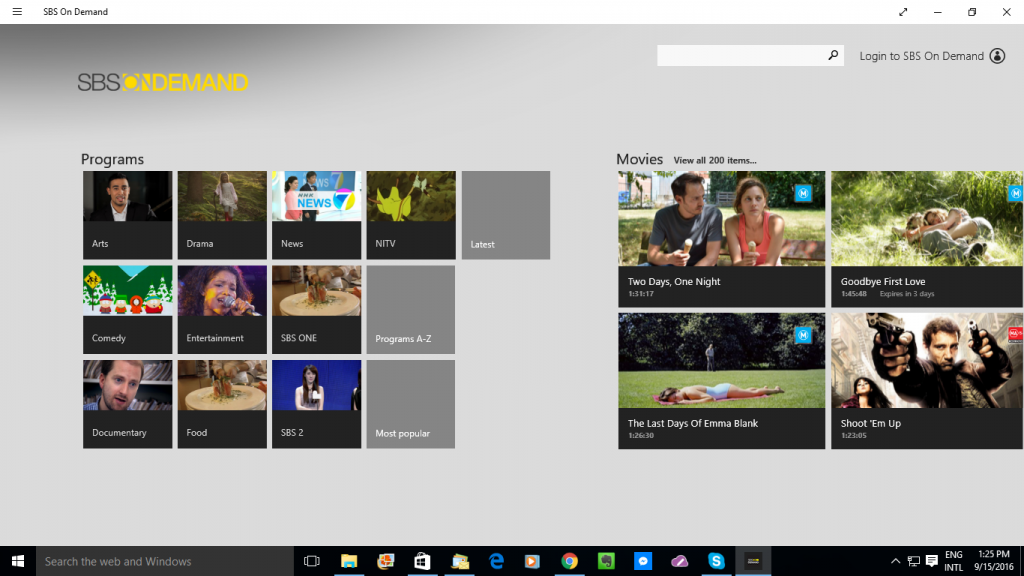

The video-on-demand sphere also exposed a significant number of providers offering this kind of content such as SBS on Demand, Walter Presents, and Netflix. In the case of viewing foreign-language content on Netflix, there is the option to select an English-dubbed soundtrack or an original soundtrack with English or original-language subtitles.

In a significant number of cases, foreign TV producers are aspiring to offer shows in a similar calibre to the English-language fare offered on the BBC, HBO or Netflix and are vying for their position in the “premium TV” landscape. This kind of content is best described as high-quality content that has a strong appeal with discerning audiences. That is while foreign-language cinema is perceived to maintains that independent artsy non-Hollywood vibe.

Add to this an increase in co-production efforts by non-English-speaking foreign TV producers / broadcasters with English-language TV producers / broadcasters who appeal to discerning audiences. An example of this that I saw for myself is the Norwegian crime drama Lilyhammer which was a co-production effort between Netflix and Norway’s public-service broadcaster NRK, but was shown on SBS in Australia before Netflix set up shop there.

Language-specific content hubs

But an increasing number of language-specific content hubs are setting up shop in their home markets and primarily delivering video-on-demand content produced in the languages supported by that hub.

The first kind of this content-hub class are niche content providers or broadcasters operating in the language’s home country or a country that has a significant diaspora who speak the language. This could include a pay-TV operator in the language’s home country who wants to create their language-specific content hub based on their original content. On the other hand, the second kind of content hub represents an alliance of public-service and/or private commercial free-to-air TV broadcasters in the country or countries that speak the hub’s languages.

Examples of the former type include Univision who offer Latin-American-Spanish content to the US’s Hispanic community, and France Channel who offer French-language content. It can extend to Canal+ setting up international operations in order to offer their original French-language content. Examples of the latter type include LOVETv which is a European-Spanish-speaking alliance comprising of Aresmedia, RTVE and Mediaset Espana; Salto who is a French-speaking alliance of France’s free-to-air TV providers; and Joyn who is a German-speaking alliance of Germany’s free-to-air TV stations and the ViacomCBS platform’s German-language outposts.

More of these content hubs would start to surface and refine their offerings; especially if they or their partner broadcasters are producing a significant amount of original content. These providers could realise that there is an international market for their content especially if there are overseas viewers out there who are interested in their offerings. This can range from expats and migrants who have the language as their native tongue or those of us who have some familiarity with the language and its associated culture.

Localising to the English language

The question for these foreign-language content hubs is whether they need to offer English-language localisations of their content and what method. These services could implement at least subtitling as a way to localise to the English language, although a dubbed English-language soundtrack option can work for children’s content or animated shows.

An English-speaking person who is familiar with the hub’s indigenous language may still need to benefit from having the content localised to English. This is due to different areas of the countries speaking that language using dialects and accents local to particular regions that they aren’t familiar with. Add to this the use of new words, colloquialisms and slang in film and TV that is something you wouldn’t learn from most language courses or textbooks, something that will impact people who have learnt the foreign language but are out of practice.

A lot of these shows that are shown in to English-language countries will already have been localised to that language, typically through the use of subtitles. This can be shows that SBS, BBC4 or a premium cable-TV channel in the USA had run at some time. Or the foreign-language content producer offers International-English or American-English localisation as part of the package when they offer shows to TV channels or VoD services.

But there is a lot more content that hasn’t been localised to the English language but could appeal to the viewership. There would be the question about whether it is worth localising the rest of this content especially if it does reflect the country and its culture. Here, this may be assessed based on the kind of content that is being viewed on these language-specific content hubs.

Deep localisation

An issue that can crop up as far as localisation is concerned is whether to engage in what I call “deep localisation”. That is to use terminology and slang peculiar to a particular market in the subtitles such as referring to public services using the same names as what would be used there.

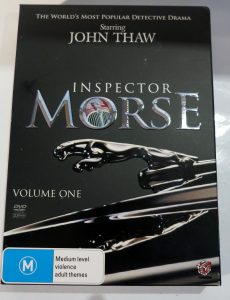

An example I had seen for myself was SBS’s effort to localise earlier episodes of Inspector Rex (Kommissar Rex) to the English language. Here, they localised the earlier episodes of the series for the Australian audience by using Australian-English subtitles. For example, an episode that involved a panel beater (car body shop) referred to the passenger-car-based pickup truck used by that workshop as a ute in the subtitles. Some other episodes referred to the Austrian public health insurance as “Medicare” to be equivalent to the same public health insurance operating in Australia.

Most likely this was because there wasn’t much activity going on in the Anglosphere with respect to English-subtitled foreign-language TV content at the time SBS acquired the broadcasting rights to that show. But the Austrian produces of this show ended up taking on the job of localising Inspector Rex to English due to this show gaining popularity in more of the Anglosphere thanks to cable TV and video-on-demand offering this kind of content.

Popular and light entertainment content

There are some content types that are not likely to be of interest to English-native viewers that look for foreign-language content. These are things like soap-operas, reality-TV, romantic-fiction or simple police-procedural dramas which may be frowned upon by viewers who have discerning tastes. It is more so where the content mirrors story-lines used in Anglophone popular content without conveying the colour of the show’s native culture.

But some people may find that viewing popular entertainment content produced in the other country, having the mix of foreign language dialogue and English subtitles may give that series an air of perceived legitimacy. This is similar to the use of an e-reader or tablet to read romance fiction and similar guilty pleasures in order avoid being scoffed at by others.

There are two good examples of this. One is “Gran Hotel”, a Spanish-language TV series ran on Netflix which has the style of a telenovela or soap opera but is set in an early time period. Another is “112 Sie Retten Dein Lieben” which is a simple fire/emergency procedural drama created by RTL and set in Dusseldorf that has some soap-opera-style melodrama in it. Here, SBS localised this German-language show with English subtitles and ran it on their relatively-new SBS 2 digital sub-channel as “112 Emergency” in 2009. Even the aforementioned Kommissar Rex (Inspector Rex) would have fallen in to this class of content due to a simple police-procedural storyline and featuring a hero dog.

It could be found that the foreign language in the dialogue uttered by original speakers with the English-language subtitles on the screen and, perhaps, an unseemly English-localised show title may work as a means to obfuscate the fact that the content has that popular-entertainment feel about it. That means that the show may earn a level of respect in some societal circles.

It is although the show may convey societal attitudes that are very endemic in its home culture and work differently to what is expected in Anglo-American cultures. This can be through interpersonal relationships or workplace dynamics that are woven through the show’s plot thanks to it being written for its home market.

This is more demonstrable with content produced in European countries where social issues are effectively woven in to the show and examined from the European country’s point of view. In this example, this concept is seen as being of value with those Anglosphere societies who align with Continental-European values.

For example, a German TV drama will underscore the strong separation of work and personal life that is part of German culture such as the importance of “Feierabend” when work ceases. Or a significant amount of German and Scandinavian police dramas have been known to give significant space to social issues rather than focusing on the “whodunnit” or “goodies vs baddies” aspect.

Conclusion

If there is a significant and continual interest within the Anglosphere for foreign-language content that has English-language subtitles, there will be an interest in offering to localise such content that way. These foreign-language content hubs that operate on the Internet to offer linear broadcast or video-on-demand could then offer to fill that niche.